What financial goals should I set for myself?

Do you really think you are good at decision-making in term of finance? Or have you been putting efforts at your work place, but you are left with nothing in the end of the month. On the other hand, inflation and recession can’t be ignored for the cause because they are one of the main issues.

Despite this entire if you don’t look at it practically and set up your financial goal. You will probably be feeling the same way as you are now. If your dream is to see yourself lifting financially then this is the right place you have reached now.

This article is going to be very beneficial for you to help you setting financial goals with an effective way. You need not to worry about it because it is not as much as difficult you think. Stay with the article-reading and learn how you do that with some smart tips for setting financial goals.

10 smart financial goals to consider this year:

Your goal should be specific:

Maximum people are failed setting up their financial goals due to having a weak financial vision. You may come up with an idea which is about bettering your financial condition. Is that enough? Continue your reading…

How about taking over your unpaid debts? This is where a large number of people lack and become the victim of a debtor after applying for loans. And they are unable to pay that back in the end.

It’s time to scrap your oldest debts. For that, what you can do is arrange some extra money and do the analization what if you are able to hit your goal.

Set up a budget:

Setting up a budget may not be very interesting because you have to spend less than making money. Spending less pushes you to restriction, but this is what you have to do. You can follow the ideology of categorizing things systematically such as your daily based expenses.

Types of expenses may include: living expenses, expenses for food, spending hard earning money lavishly with friends and etc. Now you are required to focus on your overall income that you have and expenses of household for a budget settlement.

Build emergency funds:

Things are inevitable in life so this is very important to step out carefully and financially. The perfect solution is setting up emergencies funds that is going to give you enough relief during any financial crisis. There are various types of emergencies. Most of them include:

- Medical problems: This means accidental cases can be anywhere and anytime with anyone. So emergency funds can help you tackling them at the same time.

- Job gone: There are various reasons behind job losing, but what if it is the situation then emergency funds can help you continuing your survival.

- No money to buy food: One of the emergencies when you are left with no money and you are hungry. You can’t starve if you have maintained your emergency funds. Although, this situation doesn’t occur very often, but sometimes you can’t avoid the situation.

Make an investment:

A reflection of history keeps repeating that making an investment all the time never goes in vain. Many times, people see their money-growing with time after the investment in the stock market as far as is concerned.

Inflation matters a lot here that makes the value of your cash affected as time is passing which brings a fear in heart. But it is always a good idea to know about how to make an investment from your consultant then doing the investment can bring fruitful results.

Remove pending debts:

If debts are pending then it is the right time to eliminate them all. Yes, this might not be possible for the debt-elimination at the same time when there is debt-hoarding.

But this is a fact that you can’t ignore- such debts will not allow you moving ahead financially whenever you owe something to pay ahead. So if you have decided to set a financial goal then you will have to get rid of these debts pending then think further what you have to do.

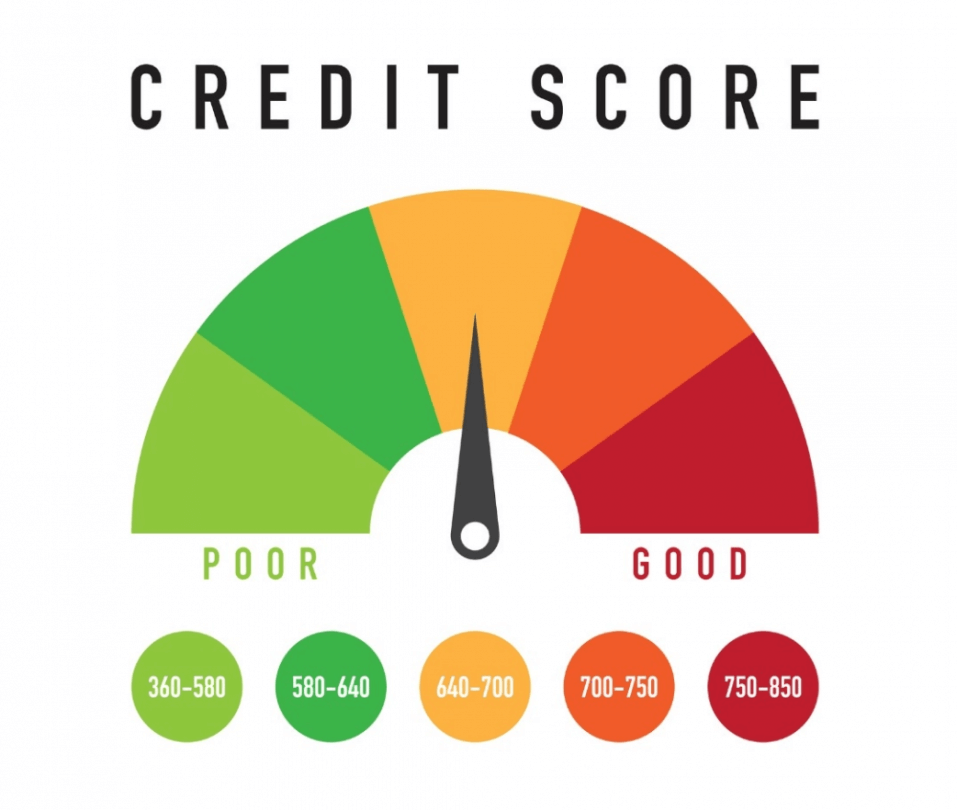

Improve credit score:

Your credit score is very essential so you can think about improving it because it is associated to your financial goals. Everybody is aware that a good credit score means a lot in almost every sphere of finance.

From applying for loans or any other financial services to using credit card or else in getting a job, your credit score remain on the top. So you need to give your credit score a protection by checking that on the daily basis will certainly do best for you.

Seek financial advisor help:

When you don’t know much about what to do about setting up financial goal. Then, it is always a great idea to sit in front of a financial advisor. After the analization about your overall financial background, they can help you with some plans that will work best for you.

They can also help you ahead with some fitted products and services that you can apply into action for getting a wondrous result.

Any plan for retirement:

This is also a goal called when you are saving some money for your retirement because nobody knows the future. But yes, if you have money then your confidence remains high in all the situations.

This would be nice if you could have a look at the good retirement investment. You may be surprised after you make an investment for your retirement out of your household income.

Multiple income ideas:

Apart from doing a job, if you can come up with extra income ideas will help you a lot for setting up financial goals. To set up a financial goal, you can resort to some following ideas below:

- Doing a part time job is wonderful thinking apart from what you are doing professionally or unprofessionally.

- You can start a side business which opens a door to money-earning.

- If possible then you can do freelancing as well to make a source of extra earning.

Stay away of addictive stuff:

An addiction to anything is not good from every aspect because you will spend money as soon as you like something very much. This can be one of the obstacles that may not allow you setting up financial goal.

Types of problem may arise:

- Your money is not in the right direction because it is going into some stuff.

- It leaves you with no financial benefits because this has become a capital trap for you.

- Stuff kills your time so that you can’t think where to invest your money finally.

- During your financial difficulties, you may put your efforts for the stuff protection and their maintenance. This is not what you have to target for consideration ahead.

Melanie Hope has been working tirelessly to write some more interesting and informative articles mainly related to money management, credit debts and saving money tips. She love her job and do it from anywhere and anytime when an inspiring topic striking her mind. Melanie earn her degree in Economics and Finance and then starting career as a professional writer.