Can Military Get Payday Loans?

This is a common scenario with almost with everyone. Despite you take care all your financial responsibilities such as making payment on time and other obligations are met successfully by you. Still, some surprising expenses surprise you with their presence.

Now a few days left to your payday can’t make you pass them easily until you arrange some little extra cash as soon as possible. Being a military personnel, can you get faxless payday loans if your situation is similar to others who need a little cash before their next payday?

While searching for the answer to this question, you must have gone through all possible ways. But you may not be satisfied with the responses you got. You need to keep your eyes on this article and experience what makes you satisfied with the answer, you are looking for.

Military payday loans can be a great and better option

No doubt, there can be no other option than payday loans for military members during your financial crisis. There are some lenders who can help to military Airmen or Air Force families whenever some additional expenses tend to disturb.

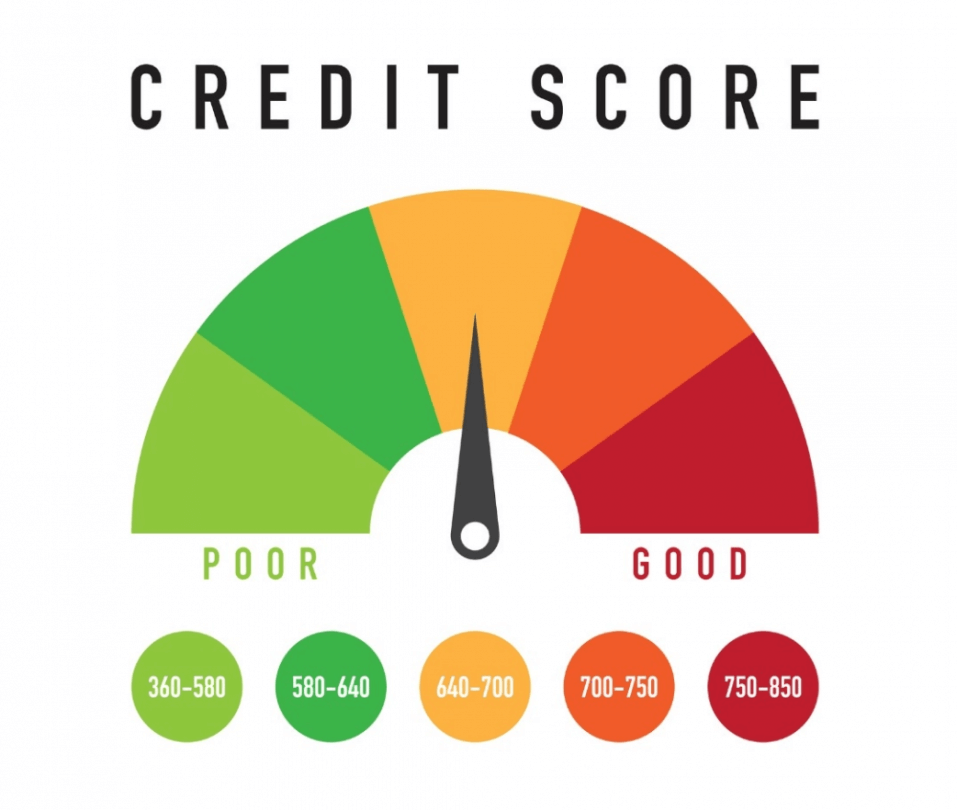

The interesting thing is you don’t need to make any physical visit to apply. Apart from that, your bad credit score wouldn’t be an obstacle in getting approval. The overall process to apply for such loans is online with a simple application form.

It means you can complete the process in 5 to 10 minutes only and funds will be with you in next a few minutes from getting approval.

How do military payday loans work?

Payday lenders help borrowers to get some respite of their emergencies by making them able to take out short term loans until their next payday arrives. Thus, the title of such loans is known as payday, but you must get the loan approval.

Once you get the approval then you need to give a postdated check by writing. Or else you are required to grant a permission to your lender for taking out their funds from your bank account directly. As soon as your salary is credited to your account then your lender debits the amount that you owe.

Things to remember before applying for military payday loans

Nobody can wait much at cash shortage when expenses are on and money is needed most. Many find a great option to take out a loan from payday lender for passing the time until their next payday. But this is not easy as much as it seems with traditional lending institutions such as banks.

It is better to consider a few things before making the final decision to loan-applying. Remember, this is applied to those also who are not a member of military.

Top things for consideration:

- High interest rates: Before you apply for payday loans, you should check out the interest rates because interest rates are usually high of such loans. Some traditional lenders have some sort of fees and penalties to impose if you are irresponsible for these loans. So this is very important to note that you make your loan payments on time after applying for such loans.

- Read terms and conditions: Before signing the loan contract, you should read terms and conditions very carefully so that there can be no misunderstanding. This will give you the clearance that you are not aware. Each and everything is included on the agreement that shouldn’t be neglected.

- Approach trustworthy lenders: There are many lenders who don’t hold license. Still, they are offering loans to the people at exorbitant charges than actual charges. So you need to be alert from such untrustworthy lenders. This is your right to ask for their license if you are under suspicion with their work.

- Serious consequences for unpaid: Not making payments on time can have the serious consequences in form of additional charges. Even your account might go to collection agencies that have set up their own charges as fee which resulting be added to your credit bureau for further action. Your relatives, friends or employers can be approached by several lending institutions to money recovery. It is nice to make your payments on time before all these events.

Is there risk with military payday loans?

To get fast money, military payday loans seem to be very attractive on the first glance because they are quick and easy to apply. You can get your money instantly the same day, you apply for. On the other hand, these loans come with some risky factors.

Yes, you heard right. These types of loans are risky if you are not serious about loan repayment after taking out such online loans from your lender. Let’s try to find out what risky factors you may have to deal with.

An accumulation of risky factors:

- Interest rates are bit high: You will have to pay high interest rates than other traditional loans because such loans are for a limited time period.

- Short time for repayment: You don’t get enough time for loan repayment so you have to pay back the loan on your next payday.

- Additional fees: Some lending institutions charge additional fee considering your current financial condition and need for money.

What military payday loans can help you with?

You can use military payday loans for meeting short term financial goals because they are designed to repay once you have used them. For example, if you are coping with a debt problem then these types of loans are the best solution for you.

Apart from that, there are various types of expenses that people keep on dealing on a daily basis. Sometimes, they don’t have enough money to tackle them all which makes them apply for the funds. Let’s try to find out what types of expenses can be managed with such online loans.

Types of expenses to tackle:

- Rent payment: You can use the funds to pay off your rent because due date has arrived to rent payment, but not your payday yet.

- Travel costing: Interestingly, you can cover the cost for travelling with the help of military payday loans.

- Medical expenses: You can pay off medical expenses as well using such loans because nobody can escape of medical emergencies.

- Household appliances: Household appliances due to frequent use, they stop working while getting older. Maybe, they are required some maintenance. so payday loans can cover their costs.

- Tyre replacement: You can replace the tyre of your vehicle so that you can get back to your work on time before you are noted.

Melanie Hope has been working tirelessly to write some more interesting and informative articles mainly related to money management, credit debts and saving money tips. She love her job and do it from anywhere and anytime when an inspiring topic striking her mind. Melanie earn her degree in Economics and Finance and then starting career as a professional writer.