What are the major pitfalls with payday loans?

Sometimes, payday loans are to be the perfect solution for sudden emergencies as uninvited guests to trouble you. After all, it is a life where people have to experience occurrences of things when they are not ready to manage them.

Such loans are very easy to apply no matter what your current financial condition is. The good news is people can use payday loans for anything with no restriction. Even those people who live on paycheck to paycheck, can have some respite of unexpected expenses during their cash shortage.

On the other hand, 33% of Canadians use alternatives of lending sources due to some pitfalls attached with such loans. No doubt, you can get relief of your current worse financial conditions using these loans, but you should also be aware of some drawbacks.

To know more about them, you should stick to the reading so that you can’t go back with an empty hand. This article will help you in understanding some pitfalls of these loans.

What are payday loans and how do they work?

Payday loans are short term loans instant that give you an instant relief by covering some major expenses until your next payday arrives. The most important thing with such loans is that they are very quick and easy to access by any loan applicant with fast approval.

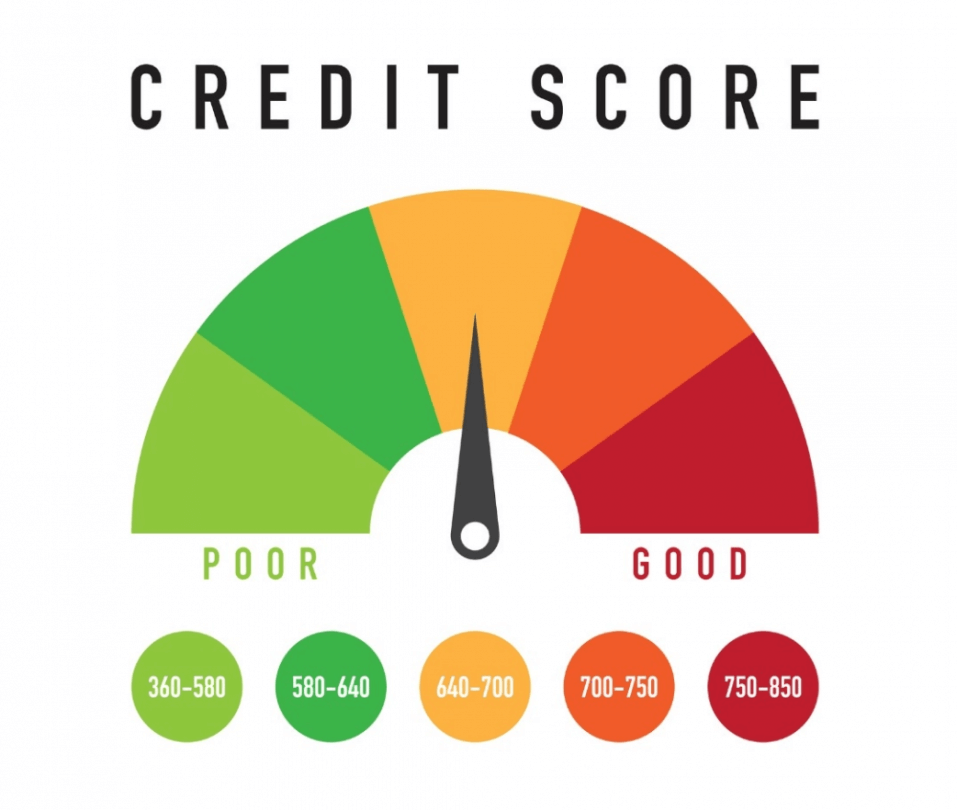

Some online lenders can get you loan approval in minutes only. No matter, how your current FICO score is because your current financial conditions matter a lot for them. The good news about such loans is you can cover your daily based expenses from paying rent to covering utility bills.

Apart from that, from bills to buying food including medical expenses can also be tackled very easily. Almost all payday lenders want you to prove your ability for loan repayment which can be in the form of income proof.

So you need to make sure of paying back your loan on time as soon as you have used them. In some cases, a few lenders don’t check your repayment ability because they take a risk for you. That’s why you have to pay high interest rates while making the loan payments.

You may have to pay high fees too if your loan payments are not on time. Then, you will need some extra money to get rid of your first loan, you applied for.

Top 5 pitfalls of payday loans:

Since payday loans are tempting to take out during a financial crisis, before you take the step, you should know their pitfalls. These kinds of pitfalls may not be bigger than any financial disaster with having no cash left.

There are top 5 pitfalls that you should consider first before you resort to these online loans. You must know that there is nothing for free in this world so it is better to be alert and put the step ahead with care.

- High interest rates: You can apply for payday loans in Canada with lump sum amount up to CAD 5000 with fast approval rate and repayment period of 14 days. You need to pay off your loan with high interest rates and fees. These types of loans are different from traditional loans to resolve your current financial hurdles, but with high costing.

- Debt cycle: Since payday loans are repaid in two weeks after using, there are many borrowers who are unable to pay off their loans on time. Thus, they apply for another loan to pay off their first one. This is where they are trapped to clear their debts and they find it challenging because they need to take one more loan.

- Unhealthy Financial Behaviour: It is a good idea to apply for payday loans, but one of the problems is you will have a temporary solution. This sometimes makes your financial living unhealthy due to unhealthy saving and some spending habits are also liable for that. People are seen to get failed for their finance management. The management of finance means setting up a budget is prominent, but less people succeed.

- Ruthless debt collector: If you don’t make your loan payments on time then lenders use different tactics to get back their money. One of them is sending your account to debt collector which is really bad. First of all, this will be on your credit report making all your attempts fail for getting financial assistance ahead. Some Unscrupulous debt collection agencies recover lost funds by threats and frequent calls or emailing.

- Account access with lender: Lenders usually get access of your banking details for income verification, setting up payments and fund deposit. Sometimes, you allow your lender to debit the borrowed amount from your bank account. Holding your bank account details can also be one of the pitfalls because your bank account contains some confidential details, but someone else has got the access.

What are alternatives to payday loans?

Rather than you propel yourself into pitfalls of payday loans, it is a good idea to consider some other alternative sources when needed some additional money. This is also not important that you can get instant funds right away until you meet the specific lending criteria of lenders.

Again, payday loans are the best option for fast money arrangements. But this is also not bad switching to some available alternatives for getting some extra money.

Consider some alternatives:

- Secured loans: If there are challenges in getting unsecured loans then secured loans can also be suitable to you using any of your assets as collateral. Secured loans can get you instant funds on the basis of your valuables. You can approach such lenders who offer secured loans with instant acceptance.

- Credit Union is helpful: Credit Unions are also known for help you out for getting fast funds whenever you feel a need for that. Such institutions value additional approval things above your FICO score too. You can go for such option if you have needed some extra cash and you don’t want to apply for payday loans.

- Family and friends: A help is something that poor or rich, both need at a time. So you can freely approach your family members or loyal friends who understand you. You can borrow the loan amount from them on a request and rest assuring them to pay off their money on time. They can surely help you out in such a situation.

- Ask for an advance: Some employers understand concerns of their employees and they are ready to assist with funds. Remember, humanity is hidden inside humans so your boss can get you the funds arranged. You are required to ask for some cash in advance from your boss putting the current condition you have. There is a strong possibility for you to get the funds from your working place.

Melanie Hope has been working tirelessly to write some more interesting and informative articles mainly related to money management, credit debts and saving money tips. She love her job and do it from anywhere and anytime when an inspiring topic striking her mind. Melanie earn her degree in Economics and Finance and then starting career as a professional writer.