Best 5 Financial Tips When You Start To Planning New Family

It is a considerable topic to continue family as it is a cycle which keeps on evolving from one to another with sources. It seems, impossible to follow the same path, where finance is scarce for accumulation which plays an important role in family continuation ahead.

There must be a family planning because family planning is based on money. And money sources either must be better or there should be cut off in expenses to raising children and fulfilling their basic requirements.

It is always a good move to starting a family, but along with it, considering sources also matter a lot. Because of the acquisition of sources, financial perspective is deemed to act upon family planning, and it is the major fact to provide happiness.

Rather than planning a new family, there should be planning to increase the source of income because, in the end, it will be more helpful. Raising children and looking after the family by money, and the same one gives tense due to shortage of cash when planning has come true.

Today, we are going to give you some tips on how to maintain finance before making family planning. And these financial tips can help foster a family, especially, children for nurturing them by availing enough sources for them to thrive to success in their life.

Here are best 5 tips to family planning for fostering, splendid.

Planning for saving

It is the backbone of fostering a family with sources, and most of us, forget to plan about saving before starting the family. Money can bring everything, a family needs, and it is the happiest moment of living with family without any scarcity of anything.

Arranging an extra income after working hours have completed with the firm, you are working for so long. It is a better idea to look out for extra earning by doing any part-time job, which is the symbol for family planning.

It is also very important to not use the earned income through other sources because expenses can’t stop chasing. It is very considerable to deposit the second earned income.

5 Ways To Save Money On A Tight Budget In 2019

End all debts

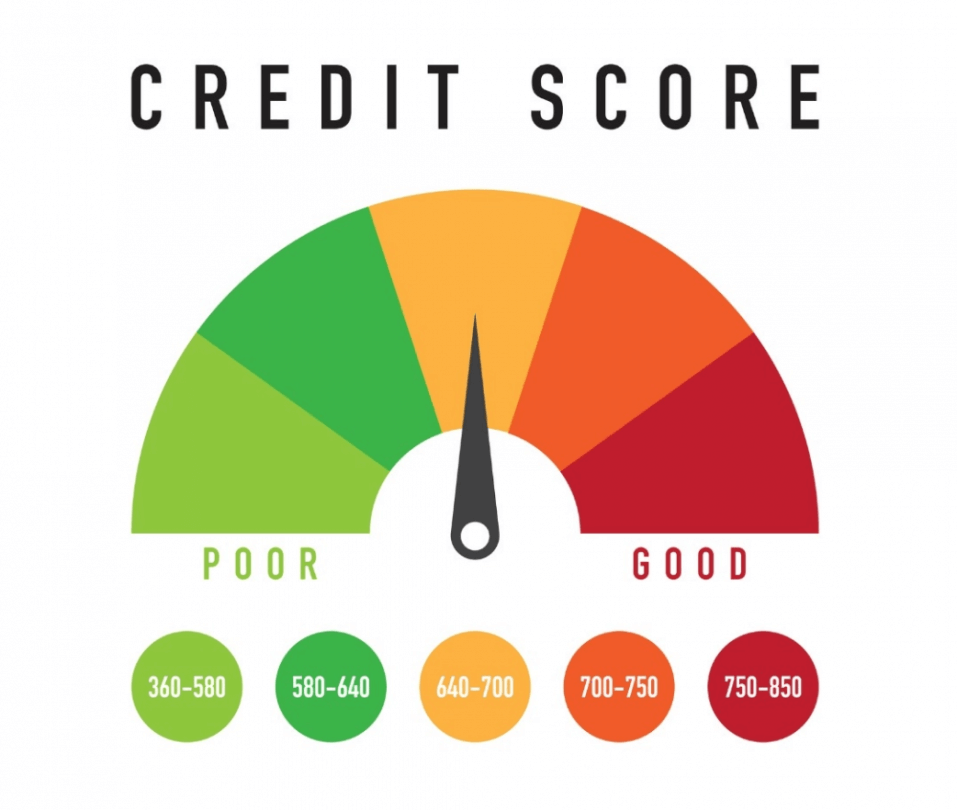

It is also one of the issues which play the role of impeding in the way of planning something good for the future. Because you can’t think further, till then there is debt cycle running and affecting the credit score due to default making payments.

So first of all, it is necessary to eliminate all debts, then this move of planning will work in raising a family. Because debts can deprive of all the benefits, you are supposed to get after being a bad credit holder and opposite it, if you are a good credit holder then literally, it can help a lot financially.

A plan for financial collapse

An emergency can knock the door anytime, and it can break into your house to ruin everything, you did slog hard for years. Arranging funds for an emergency can also play a crucial role to prevent you from derailing off the track while living with happiness with your family.

Awareness for further sudden expenses can heal the wounds after hitting, instantly. So it is also a protection for a family, living with available sources, getting from a good earning. Being alert from any fall is the protection with sources to avoid any injuries.

A control over spending

Spending does not have any limit, depending on the source of income still, people seem failed to fulfilling desires after having a standardized income. A control indicates future planning because there is a need for enough money to make the dream come true, along with 100% efforts.

So controlling directly indicates a dream, it can be future related or family related to live with happiness. It can be possible to bridle unnecessary items from buying outside if there is a planning. It is better to resort to austerity for saving money to educate children in English medium school.

Focusing budget

This is a supreme effort to saving for family planning because budget making is required to know expenses and unnecessary expenses where they are. Now unnecessary expenses have to be eliminated after the budget has been revealed.

It can save from the items; which do not need to take along due to desire fulfillment only. Now, it has turned into a habit to obstruct the way of planning for having children. It is important to look at the current budget and remove unwanted items that are hindering to new planning for a wonderful family.

Why Are Faxless Payday Loans Good To Stable Your Monthly Budget?

What Do to starting a family financial planning?

A family planning is dependent on financial stability, and it is made, but it takes enough time, along with efforts with destiny role. Most of the people plan for saving and give their 100% remains behind all hopes to accumulate money.

It is better to keep on doing because financial planning can be a bit harder, but not impossible as we all know about it. With continuous efforts to accumulate money will certainly give astounding results in attaining money, at the end to make a family happy.

As there are many options to collect money, but always choosing the easiest option, is the big deal by looking for part-time jobs for example?

Conclusion

Saving planning requires efforts and it is also not necessary to look out for a part-time job because there is no specific amount needs here. It can be any amount of salary to acquire through any source not by getting a job and then it can be arranged from anywhere.

A family has several expenses to meet and there is no specific time to meet with those expenses, so saving money must be there. People, generally don’t consider about money arrangements, they continue pondering over tense.

Melanie Hope has been working tirelessly to write some more interesting and informative articles mainly related to money management, credit debts and saving money tips. She love her job and do it from anywhere and anytime when an inspiring topic striking her mind. Melanie earn her degree in Economics and Finance and then starting career as a professional writer.