What Affects Credit Score Negatively? Let’s Check

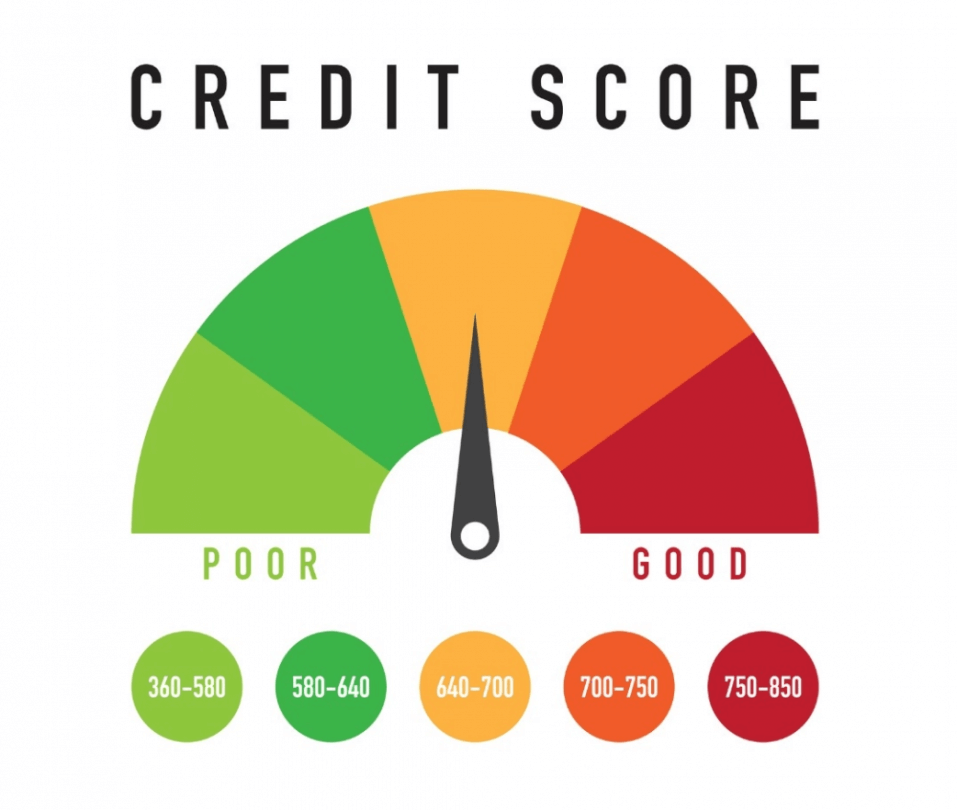

Generally speaking, credit rating is a three digit number that every earning individual has mentioned in his/her credit report. The number of credit score can vary from 300 to 850. Based on this three –digit number one can realize to get fiscal help in any form of payday loan, personal loan, title loan, mortgage, credit card or other line of credit. This rating gives the clear picture of your present financial condition and previous monetary capacity that help the lenders to decide to credit or not.

Some situations crop up, when you are not able to pay bills on time, got late for making the repayment, misses the payment and other such defaults that directly affect your credit rating and put it in a negative condition. Not only has this, bad or low credit rating affected virtually every aspect of your life by making it back breaker for you to get credit. To put it simply, bad credit scores can affect several things in your life that listed below for your convenience to understand. Due to increasing number of bad creditor, many lenders now offer faxless payday loans no credit check. They didn’t performing various types of credit checks and approve loans within 15 minutes.

Mortgage

One of things get badly affected by the bad aspects of credit rating is inability to avail mortgage. For suppose, you are planning for days to buy an apartment but all your efforts will go in vain because of blemished credit report. Financial institution will possibly deny you the mortgage due to adverse credit factors involved in your profile or either charge high rate of interest. Since high risk is involved in getting loan for a home, so lenders take precautionary measures to charge high from your side that badly affect your whole budget.

Credit Card

Because of the fact that, lenders believe you are high risk customers and for this reason, they would charge higher price from your side. If you have applied for a credit card and get the approval despite of having not so perfect credit history, then it will definitely going to affect your interest rate. Generally, the credit card interest rate lies anywhere in between 7 to 36 percent. For good creditors, it falls anywhere in between 10 to 19. However, bad credit scores get badly affected by it who have to pay somewhere around 22 percent as interest rate on the credit card.

Cell Phone Plans

Cell phone plan is one of the things get affected by blemished credit profile. What happens is that, many network operators check credit background of the potential customers to check whether they able to pay bills in the future or not. They feel content to extend their support to poor credit scorers without having guaranteed to get bills paid on time. Thus, you will see the exact effect of past credit mistakes on your future plans.

High Insurance Premium

Insurance companies also determine the insurance premium depending on the credit position of customers. According to them, lower credit scores are linked to higher claims. Under this, your credit profile is check and in case any default is found, then higher premium will be charged. Why Was My Loan Application Declined?

Christopher is an enthusiastic writer and blogger, who want to change the world from his writing skills. He wants to present his opinion publicly and spread the awareness about the common financial issues and importance of money management. After completing his graduation degree in computer science, Christopher come to Ontario, Canada and enjoy reading, researching on new topics in his free time.