Can You Get a Loan If You’re On ODSP?

Are you one of them who is living with disability? Also, you are getting Ontario Disability Support Program. Despite this, you have met with some emergencies where you need some extra urgent faxless loan instantly.

Stop worrying about whether you can qualify for a loan or not. This is not going to be complicated because there are many options that will favor you. Do you know that about half a million Ontarians and many dependents are ODSP beneficiaries?

If you have no idea about that then you need to stick to this article reading because you have reached a right place now. There are many things will come out such as types of loans are there, who can go for them and loan uses for whom?

Surely, this article will help you understand better whether you should apply for loans while you are on ODSP. So continue reading ahead.

What is Ontario Disability Support Program?

Surely, you should know first about Ontario Disability Support Program before you take the final step since you many of you people must not be aware. Basically this type of program is very much lucrative to the people in giving financial and employment assistance in Canada. One of the interesting things is this program is divided into two different parts.

Two main parts of Ontario Disability Support:

Income support: As the name reveals when you have no income to meet with your basic needs then you can take advantage of such a program. This program is going to takes care all your basic needs without having an income. You will be able to cover various types of expenses including housing and food.

There are some other benefits associated in case you are qualified for this program. These benefits are health benefits as well as assistive devices that assist you for moving from one place to another.

Employment support: Employment support program is for those who can work or else they want to work. Such type of support helps for a job preparation as well as in getting that. But there are some other things that matter such as your current condition. Most importantly, what you can expect are following:

Assistance in job finding

- Job coaching is there

- Software and mobility are available making you do your job well

- A facility of assistive devices

- Transportation facility is also available

- You may expect assistance for a business too

What kind of loan is ODSP loan?

Now, let’s just find out what ODSP loan is after we have known what ODSP is all about. Straightforwardly putting, this ODSP loan is similar to a personal loan for the people who are dependent on ODSP.

You must have thought about it whether you can get approval for loans if getting ODSP or not. The good news is yes, you can go for such loans while you are on ODSP. Surprisingly, you may get what you didn’t expect, means you can go for a higher loan amount.

What makes this possible is your ODSP income you are getting from your government. This is considered as an income to qualify for any financial assistance like a loan. Lending institutions prefer offering financial support to those who can repay their loan on time.

What are minimal requirements for loans on ODSP?

This is a question that keeps on hovering on the minds of people with ODSP benefits. Whether you apply for payday loans or personal loans, you will have to provide some essential details that belong to your finance.

Since requirements depend from lender to lender, still some lenders have a few requirements that you can go ahead for applying these loans. So let’s just try to find more about the type of requirements for ODSP payday loans.

Loan requirements:

- Canadian citizenship: Your permanent citizenship should be Canadian to meet the eligibility criteria of lenders.

- Age proof: Your minimum age should be 18 to apply for such loans or above your age falls to match the lending process.

- ODSP income: You need to prove any income source for loan repayment. You can show ODSP income as well for getting online funds.

- A bank account: Your bank account is mandatory for receiving such online funds so you need to make sure of it while you are applying.

What are the loan types available?

There is no set comparison between ODSP loans and other types of traditional loans because they almost fall under the same category. Despite this, there are some loan types for consideration further before switching to the specific one.

Types of ODSP loans:

- Unsecured loans: Unsecured loans are basically such loans that don’t require any collateral. Relating to this, such loans are risky and they come with high interest rates for the borrowers to pay in the end. So you have to make sure of the loan repayment before you apply because interest rates accrue once you miss the payments.

- Secured loans: In case of secured loans, they are secured by some of your valuables. Lenders cover their loss using your assets if you are unable to repay their loans on time. Your valuables can be in any form such as home, vehicle or anything which has the same or above value of the loan borrowed.

- Guarantor loans: If you find any challenges in getting approval for ODSP loans, you can resort to Guarantor loans. In case of these loans, any of your friend or family members come ahead to cosign so that you can easily be qualified for such loans. But you have to repay the loan on time or else your cosigner will be liable for repayment.

Is it good idea to apply for ODSP payday loans online?

Undoubtedly, there are many advantages of applying for ODSP payday loans online being very easy and convenient for the loan applicants. You can apply for these loans from some online lenders in Canada and get quick approval in a few minutes only.

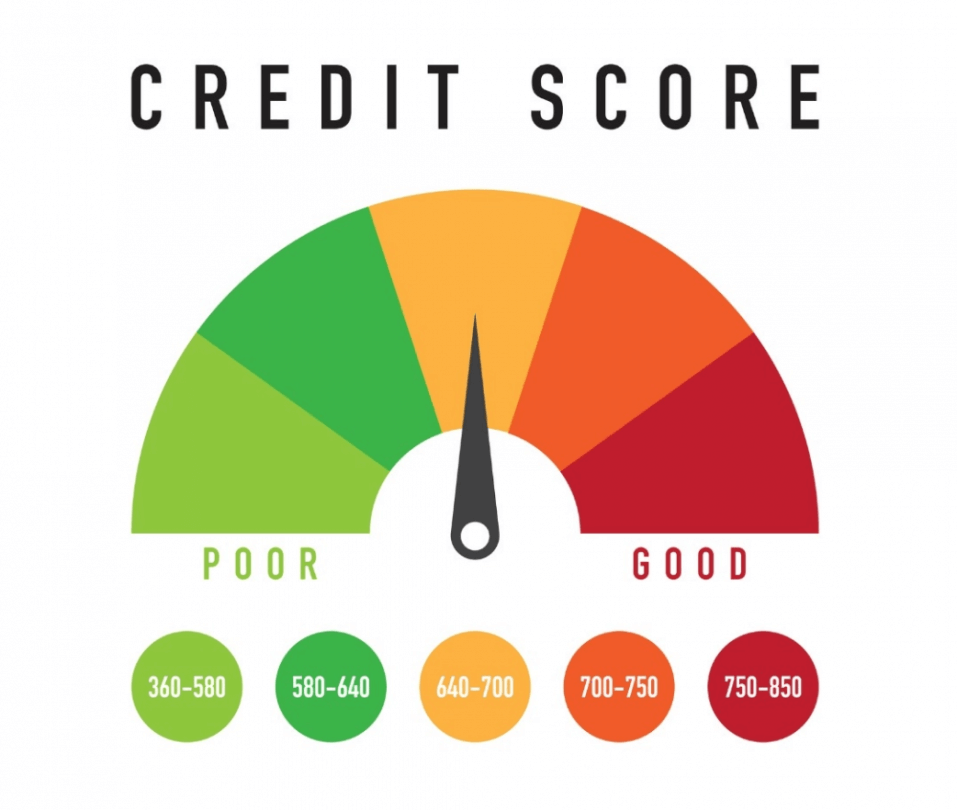

You can get the funds as soon as possible the same day once you have got the loan approval. The interesting thing is you can get the funds even your credit score is bad which is one of the main issues for getting any financial services.

Susan Leigh is a professional writer and in her spare time she used to draw painting through watercolour and acrylic. She is a diehard fan of viewing sunset scenes over the sea. In her articles, you always see the professionalism and command over the topic and money management tips that help in achieving financial success.