How can i Get e Transfer Installment Loans Canada 24/7?

Every once in a while, people have to deal with a cash shortage, no matter at what stage, they face that. But this is sure cash shortage doesn’t compare people from each other. Getting instant funds becomes very essential that’s why some lenders offer Faxless loans using Interac e-Transfer.

This is ok, needing fast money, but getting that right away might really be surprising. Yes, this is true what you have heard. You can find it much better than EFT loans that deal with funds between digital banks and other financial organizations with higher transaction limits.

Today’s article is going to be very interesting based on how you can get installment loans via Interac e-Transfer in Canada for 24/7. Apart from that, mostly, banking institutions tend to help you financially during their business hours only. This may pinch you.

What if you need some extra funds in the middle of the night? Worry not, about that because you are moving in the right direction. Just continue reading, and you will have the solution.

What is E Transfer?

You must be close to the Interac e-Transfer that is available all over Canada. The interesting thing is, you can send money to anyone or yourself using an electronic method. The minimum time, it takes for fund availability which is 30 minutes, not more than that.

Installment loans are available as fast as you haven’t thought about it before, via e-transfer in Canada. One of the things that can make you a bit sad is that you can’t make heavy transactions as compared to EFTs. This basically stands for Electronic fund transfer for doing high transactions.

It is an expansion brought by Interac—Canada’s interbank payment network to facilitate the system of debit card system of the country.

What are E transfer installment loans?

Instant E-transfer installment loans are a short-term solution to money shortages which you can use for almost anything. These types of loans are very convenient to apply with a simple application process that doesn’t take your whole day, unlike traditional loans.

Funds are sent to borrower’s bank account electronically after they are approved for such funds. The best thing is you don’t require sending any sort of fax for documentation purposes and you can borrow funds up to $5000.

These types of loans can easily be compared to other loans like payday loans. The good thing is you have to repay such loans over a period of time with a fixed amount that fits you. So you should check out the cost of such funds before applying.

How do I apply for installment loans in Canada?

When you need some extra funds then apply for installment loans via Interac e-Transfer from some online lenders. You can get approval for such funds in a few minutes only with simple steps without wasting your whole day.

You can go through these steps and get yourself approved very quickly and you will have funds with you as soon as possible after getting approval.

Apply in 3 steps:

- Apply now: You have to fill out a simple application form with some of your banking details and personal details such as income and contact details. The process doesn’t take much time for no refusal payday loans.

- Get approved: Don’t forget you are applying for loans so you need to have some patience because it takes time for verification. As soon as verification is done you get the approval and loan contract. You should read the terms and conditions of the contract before sending it back to your lender by signing.

- Get funds: As soon as you have sent the loan contract back to your lender then funds can be there at any time in your bank account. Make sure you repay the funds on time to avoid high-interest rates.

Does an installment loan require a credit check?

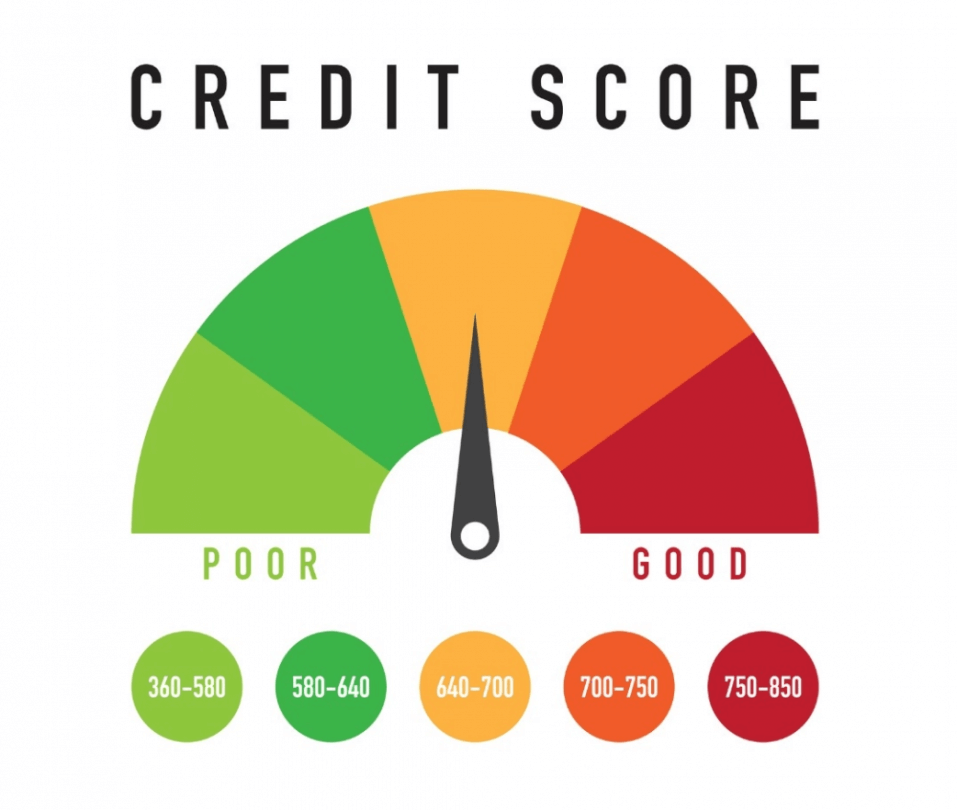

This is a fact that all lenders require a credit check before they release the funds to you. But this is also surprising not all lenders do the credit check. You can now get E-transfer installment loans with no credit check with some lenders.

You will have your funds fast now with no hassle ahead then you pay them over time with a particular loan amount until they are repaid in full. This is a different thing, you have to pay high-interest rates. There are two different types of credit check such as a soft credit check and a hard credit check. So you can find some lenders who prefer conducting a soft credit check that doesn’t hit your loan approval rate.

Can I apply for loans late at night?

Yes, you should know that applying for E-transfer loans late at night is considered same day. So, you can apply for loans with no hassle. Some online lenders are always available to work with you 24/7 whenever you have needed for some extra cash.

If you are in hurry of getting fast money then such online funds can take all types of financial worries away. Your loan approval takes a few minutes online and funds can be there anytime to your bank account from the time of getting approval.

You need to remember something until your loan process comes to an end. You have to avoid mistakes during the process because this might be the cause of rejection for approval.

Is bad credit Ok for installment loans?

Yes, your bad credit is not going to be a problem in getting E transfer installment loans with bad credit. But the only condition is you have to prove that you can repay your loan on time. One of interesting things is you will find such lenders who can offer funds accepting your bad FICO score.

Since having a bad credit score is a sign that you don’t make your payments on time, reasons can be anything. Thus, your loan repayment ability matters most to get these loans with no hassle.

For that, you will have to make your pocket tight a bit because interest rates will be high to pay along as compared to other loans.

Susan Leigh is a professional writer and in her spare time she used to draw painting through watercolour and acrylic. She is a diehard fan of viewing sunset scenes over the sea. In her articles, you always see the professionalism and command over the topic and money management tips that help in achieving financial success.