Why Does My Credit Score Matter? When I Apply For a Loan.

Credit ratings play a vital role in the life of people to get external financial help during emergency circumstances. Loan providers evaluate the credit position of a particular person to decide whether he/she is able to get financial aid or not.

What is credit score?

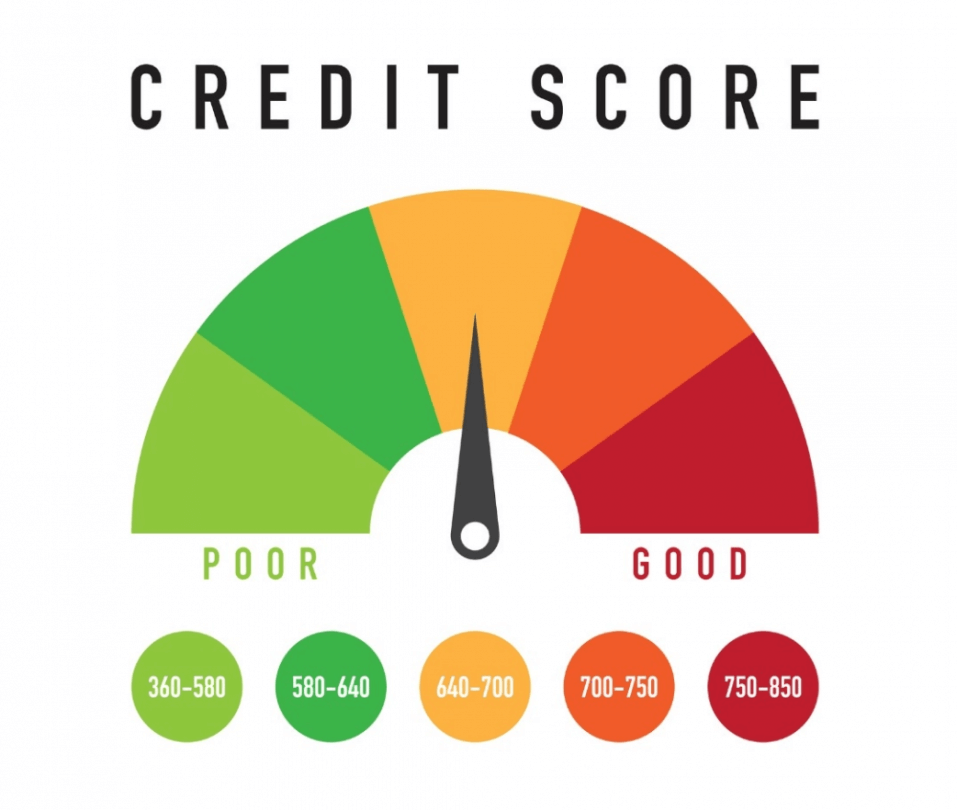

It is a true fact that credit scores matter, but before reflecting on the factors as how it matters, it is necessary to first understand what credit score is all about. The credit score is basically a three digit number mentioned in the credit information supplied by the credit rating agency.

The credit scores lie in number between 300 and 850 that is based on your credit history, mortgage debts, car loans, the amount owed and anything else. Loan providers, landlords, and financial institutions used these credit scores to determine how you pay bills on time? Do you have any pending debts to pay? How you are going to pay the next loan? What is the maximum amount you can borrow?

Is credit score is matters?

Credit score really matters in terms of getting financial help or not. Individuals suffering from blemished credit profile lack the trust factor between themselves and lenders. Loan providers are not able to offer them loans based on their previous performance of not paying debts on time.

In the position of having negative credit factors in profile, it matters a lot for the lenders not to approve your loan request. Since lenders want their money to be paid back but being a bad credit scorer indicates you as a non-reliable person is a reason fiscal help is denied for you.

If you think your imperfect credit scores affect you, then yes it affects you and one of it affects is paying a higher rate of interest on the loan. In terms of lenders, lending money to people with not so good credit position is obviously risk-taking a decision and to compensate this, they charge a marginally higher interest rate. This can cost you thousands of dollars over the course of a loan just because your bad credit scores matter a lot in the eyes of lenders.

Individuals with imperfect credit position also find difficulty in getting a new cellular connection. It happens because, cellular companies have a view that if you were not able to settle previous debts, then how you are going to pay for the mobile bill.

I have bad credit, what i do now to get a loan?

At some point, when you need emergency financial help at short notice despite having low credit ratings, then no bank or financial institution will offer you help. But, still, you can get faxless payday loans for bad credit, a loan that doesn’t need your previous credit score.

Such bad credit loans in Canada with guaranteed approval are specially designed for the people who are struggling for their loan approval but are always rejected due to poor credit score. Such payday loans for bad credit are best known for quick availability of cash and as a boon for the all poor credit history holders.

Melanie Hope has been working tirelessly to write some more interesting and informative articles mainly related to money management, credit debts and saving money tips. She love her job and do it from anywhere and anytime when an inspiring topic striking her mind. Melanie earn her degree in Economics and Finance and then starting career as a professional writer.